PPP and EIDL Fact Sheet #4

Nicole Tommell, Area Ag Business Management Specialist/Team Leader

Central New York Dairy and Field Crops

The Paycheck Protection Program and Health Care Enhancement Act was signed on April 24th. So as of today, April 27th, the Paycheck Protection Program is back in business with $310 billion more in appropriated funding. A new interim final rule was issued by SBA/Dept of Treasury on April 24th https://home.treasury.gov/system/files/136/Interim-Final-Rule-on-Requirements-for-Promissory-Notes-Authorizations-Affiliation-and-Eligibility.pdf and the Treasury Department also issued an updated FAQ as of April 26th https://home.treasury.gov/system/files/136/Paycheck-Protection-Program-Frequently-Asked-Questions.pdf.

In order to make this factsheet more efficient a summary of the PPP program can be found at https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program, and we have included links to earlier fact-sheets which provide more in-depth analysis of the PPP program. In summary, the Paycheck Protection Program PPP is a low interest (1%) loan authorized in the CARES Act designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive up to 100% of PPP loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. You can apply through any existing SBA 7(a) lender or through any federally insured depository institution, federally insured credit union, and Farm Credit System institution that is participating. The last day for SBA to approve a PPP loan is June 30, 2020.

The Paycheck Protection Program and Health Care Enhancement Act did not significantly change the PPP. The biggest change in the Act was a set aside of $60 billion of the $310 billion authorized PPP funds to be distributed through minority serving and smaller banks - with the intent of helping small businesses that had "banked locally" to have a better shot at receiving a PPP loan. One criticism of earlier rounds of PPP funding was that an applicant's ability to get funded depended more on who they banked with than their need for the program. Applicants who had banked with larger banks, BoA and Wells Fargo for example, have been reported to have had an advantage in applying as they were quicker to accept applications. Smaller banks were hesitant to jump into the PPP early on as they were (rightfully) worried about assuming risks in a program with few rules or guidance. Many community banks also had less robust on-line application portals. These delays may have disadvantaged their customers because the funding was obligated so quickly.

Because of the speed with which the first round of PPP funding disappeared, it is also clear that Congress will be looking at who gets PPP funding. Prior to the authorization of additional funds, there was widespread outrage about small businesses being squeezed out of the funding program, while large companies, with relationships with banks and the ability to raise money by issuing shares, received tens of millions of dollars. Shake Shack notably returned their loan and several hundred million more will likely to be made available to the PPP fund from large companies returning loans made in earlier rounds.

Although the recent Act did not place additional explicit constraints on large businesses, the updated April 24th interim final rule and April 26th FAQ do make it clear that need for the loan matters. The rule includes Section 5 Limited Safe Harbor with Respect to Certification Concerning Need for PPP Loan Request which states:

"Consistent with section 1102 of the CARES Act, the Borrower Application Form requires PPP applicants to certify that "[c]urrent economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant." Any borrower that applied for a PPP loan prior to the issuance of this regulation and repays the loan in full by May 7, 2020 will be deemed by SBA to have made the required certification in good faith. The Administrator, in consultation with the Secretary, determined that this safe harbor is necessary and appropriate to ensure that borrowers promptly repay PPP loan funds that the borrower obtained based on a misunderstanding or misapplication of the required certification standard but indicated that firms that don't return the funding will be subject to scrutiny by the Treasury Department that they were not applying to the loan in good faith."

The April 26th FAQ's Question 31: Do businesses owned by large companies with adequate sources of liquidity to support the business's ongoing operations qualify for a PPP loan? The Treasury Department responded:

"In addition to reviewing applicable affiliation rules to determine eligibility, all borrowers must assess their economic need for a PPP loan under the standard established by the CARES Act and the PPP regulations at the time of the loan application. Although the CARES Act suspends the ordinary requirement that borrowers must be unable to obtain credit elsewhere (as defined in section 3(h) of the Small Business Act), borrowers still must certify in good faith that their PPP loan request is necessary. Specifically, before submitting a PPP application, all borrowers should review carefully the required certification that "[c]urrent economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant." Borrowers must make this certification in good faith, taking into account their current business activity and their ability to access other sources of liquidity sufficient to support their ongoing operations in a manner that is not significantly detrimental to the business. For example, it is unlikely that a public company with substantial market value and access to capital markets will be able to make the required certification in good faith, and such a company should be prepared to demonstrate to SBA, upon request, the basis for its certification. Lenders may rely on a borrower's certification regarding the necessity of the loan request. Any borrower that applied for a PPP loan prior to the issuance of this guidance and repays the loan in full by May 7, 2020 will be deemed by SBA to have made the required certification in good faith."

What does this mean for you? First the good news is that Congress is now making more effort to better target the PPP funding to small businesses. Some of the kinks of the first round are being addressed and an attempt is being made to better reach small businesses. Small farm businesses in New York State are unlikely to be the primary focus of programmatic scrutiny and Congressional belt tightening so if you have real concerns about your markets and labor this season, you can apply for a PPP loan in good faith, even if you haven't experienced a significant loss in income yet. COVID-19 economic impacts are likely to be long lasting and should times get hard, accessing affordable credit could be a challenge for many small businesses. That is what these programs can help with.

The bad news is that it is not clear what additional requirements or restrictions there will be for PPP loan forgiveness. The PPP is a new program put together quickly. It is kind of like building an airplane while flying. As the program unfolds, the program rules seem to be establishing the groundwork the SBA to hold businesses to a standard of suffering economic harm in order to receive loan forgiveness, especially as obvious issues with funding allocation are identified. There could be more documentation of economic harm required or more restrictions placed on forgivable uses of the funding. Right now, loan forgiveness in the PPP is based on hiring at the same level you had in 2019 and being able to pay out most of the grant in the first 8 weeks after you receive funding. Some businesses are having trouble meeting this standard because of worker shortages or changes in how they are operating right now. This is something you as a business owner should be prepared for. Our recommendation is if you are applying to the PPP because, like many farms you are unsure of how your season will unfold, be prepared to pay the loan back if your season goes well and consider your PPP funds as a low interest, safety net. If you operate this way you protect yourself from short term cash-flow problems. If you are ultimately eligible for loan forgiveness then you will be ahead and if you are not, you will not be worse off. Even if you must pay the PPP loan back, at 1% interest and no fees it is a very affordable loan and might be worth having for peace of mind.

Neither the April 24th Interim Rule nor the April 26th FAQ included any new guidance to lenders about using the Schedule F or alternative sources of documentation for assessing owner income for the PPP. We are hearing that farms with negative net income reported on their Schedule F, line 34 are being denied owner income for the PPP, which is consistent with the guidance that was given to lenders for using the Schedule C in the April 14th Interim Rule. So, if you do not have paid employees and you reported net negative income on your 2019 Schedule F, it is possible you will not qualify for PPP funding. You should contact your lender to verify your eligibility prior to applying.

We had said that H2A employee eligibility for PPP was a grey area. It still is. The April 26th FAQ Question 33 did add some clarifying language about how a lender should determine whether an employee's principle place of residence is in the United States, but it is not really that helpful for H2A employers. The answer is "PPP applicants and lenders may consider IRS regulations (26 CFR § 1.121-1(b)(2)) when determining whether an individual employee's principal place of residence is in the United States." So, this is the applicable CFR language (26 CFR § 1.121-1(b)(2)):

2) Principal residence. In the case of a taxpayer using more than one property as a residence, whether property is used by the taxpayer as the taxpayer's principal residence depends upon all the facts and circumstances. If a taxpayer alternates between 2 properties, using each as a residence for successive periods of time, the property that the taxpayer uses a majority of the time during the year ordinarily will be considered the taxpayer's principal residence. In addition to the taxpayer's use of the property, relevant factors in determining a taxpayer's principal residence, include, but are not limited to—

(i) The taxpayer's place of employment;

(ii) The principal place of abode of the taxpayer's family members;

(iii) The address listed on the taxpayer's federal and state tax returns, driver's license, automobile registration, and voter registration card;

(iv) The taxpayer's mailing address for bills and correspondence;

(v) The location of the taxpayer's banks; and

(vi) The location of religious organizations and recreational clubs with which the taxpayer is affiliated.

The Treasury Department/SBA are punting on this one and it will be up to a farmer and their lender to determine if any of their H2A employees meet this test and this could vary quite a bit depending on how the farm uses H2A workers and how much time the H2A worker had spent in the US in the past few years.

EIDL and Advance Update

The Paycheck Protection Program and Health Care Enhancement Act made the SBA Economic Injury Disaster Loan available to farms for the first time. EIDL is the SBA's primary disaster assistance program to businesses. It provides low interest loans (3.75%) for working capital that are intended to help a business keep going during a period of business interruption due to a disaster. Businesses can apply for up to $2 million. The terms for repayment of the loan can be quite long (up to 30 years) with the intention that the repayment costs are low enough to help the business stay economically viable after the disaster.

The CARES Act also added the ability for businesses applying for EIDL Loans to receive up to $10,000 as an advance to "provide economic relief to business experiencing a temporary loss of revenue." The Advance does not have to be repaid and businesses that receive the advance, but ultimately are turned down for the loan, do not have to return or repay the advance if they were otherwise eligible to apply for EIDL and the purpose of the loan was eligible. Because of demand for EIDL, SBA had been limiting the Advance to the number of employees that the business had - so businesses with fewer than 10 employees were receiving less than $10,000. There has been some pushback from Congress about this reduction in the Advance, so it is unclear as to whether that reduction will continue with the new round of funding. Right now, $50 billion of the new appropriation is to fund loans under EIDL and $10 billion is for the Advance.

Unlike PPP, which you apply to through a commercial lender, you apply directly to SBA for the EIDL. SBA had closed their application portal for EIDL when funding was fully obligated on April 15th. They have not yet reopened the application portal because they had a backlog of applicants. According to the SBA website https://www.sba.gov/disaster-assistance/coronavirus-covid-19 (as of April 27th): "With the additional funding provided by the new COVID-19 relief package, SBA will resume processing EIDL Loan and Advance applications that are already in the queue on a first come, first-served basis. We will provide further information on the availability of the EIDL portal to receive new applications (including those from agricultural enterprises) as soon as possible."

There is some concern that because of the backlog in applications that no new applicants will be able to apply, effectively closing the EIDL to farms. However, because the EIDL is a long-standing program, with fewer glitches than PPP, further rounds of funding if there is enough demand and demonstrated need could be forthcoming. We advise you to keep trying to apply. Small Business Development Center (SBDC) staff are a great resource to help guide you through this process as they are very experienced with EIDL loans. You can find your local SBDC center at https://americassbdc.org/

Next Steps

You can apply for both the PPP and the EIDL and because the programs are so competitive if you need this help for your business is probably worth applying to both, just in case you are not able to access the other program. However, you cannot use the funds for the same purpose. So, if you do receive a PPP loan, it would be to your benefit to first use the PPP loan funds for salary because that use of the PPP is forgivable and uses of the PPP are more restricted. EIDL loans, for example, can be used to pay vendors and pay other operating costs. Many local areas are also developing emergency loan and grant programs for businesses, so it may be worth looking closer to home - especially if the amount of funding you need is more in the under $10,000 range.

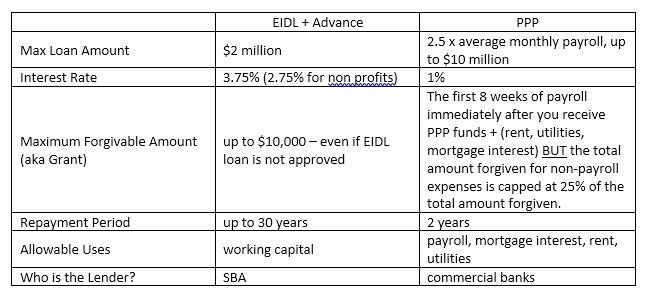

Here is a chart summarizing the differences between the two assistance programs:

See pdf for chart.

Prior Fact Sheets:

- Fact Sheet #1 CARES Act's Emergency Resources for Farm Businesses: Paycheck Protection Loan Program, April 2, 2020 https://bit.ly/358Q3Ye

- Fact Sheet #2 April 8th Update to the Paycheck Protection Program (PPP) - Where the only constant is change!, April 8, 2020 https://bit.ly/2Yamx2Y

- Fact Sheet #3 A new interim rule, the first round of funding is depleted. What does the future hold? April 14, 2020 https://bit.ly/2ScV7pr

PPP Fact Sheet #4 (pdf; 1093KB)

Upcoming Events

2025 Dairy Day

January 7, 2025 : Dairy Day - Hamilton

Hamilton, NY

New Location! Lunch Included!

January 8, 2025 : Dairy Day - Ballston Spa

Ballston Spa, NY

Lunch Included!

Corn & Soybean Day

January 14, 2025 : Corn & Soybean Day - Hamilton

Hamilton, NY

New Location! Lunch included! 2.75 DEC Credits available!

January 15, 2025 : Corn & Soybean Day - Ballston Spa

Ballston Spa, NY

New Location! Lunch included! 2.75 DEC Credits available!

Farm Succession Planning Webinar

January 22, 2025 : Farm Succession Planning Webinar

Free webinar

Announcements

Sign Up for Our Weekly E-Newsletter

We send out a bi-weekly e-newsletter that has announcements, upcoming programs, and opportunities for you! Registration is quick, easy, and free. Click here to sign up today!Document and Share Storm Damage

Mother nature has really been difficult over the last few days. Significant damage has been seen throughout NYS. Please let us know what types of damage your farm may have sustained during this time. This could be in the form of property damage, lost power, milk dump due to lost power, loss of livestock, loss of stored feed or growing crops.Farms are encouraged to DOCUMENT AND SHARE any impacts the weather may have had on their home or business. This could include structure damage, crop loss, inventory loss due to power outages, damage to equipment or fencing, and more.

If your farm experienced any sort of damage, please reach out to any of the folks listed below (or all of them). The more impact information that is collected, the greater the likelihood of a disaster declaration which can bring vital emergency support and awareness. The CNYDLFC Team will continue to collect detail and submit to NYSDAM and the EDEN network.

Reporting Weather Related Impacts (For your home or farm business)

- First, ensure that all the people and animals on your farm are safe, and that there aren't any unsafe working conditions created because of the weather (check your structures!). If there's an emergency, call 911 - don't try to manage it all on your own.

- Second, document all negative weather impacts for your farm and their estimated financial cost. Take photos, make estimates, and put it all in a safe place.

- Reach out to your insurance providers - farm, vehicle, crop, etc. to initiate the claim process as needed.

- Then, share your farm's damage with any (or all) of the ag support agencies listed below. We all work together to collect storm damage information and funnel it up to Ag and Markets which can initiate a natural disaster declaration.

- Chenango: 607-334-5841

- Fulton/Montgomery: 518-853-2135

- Herkimer: 315-866-7920

- Madison: 315-684-3001

- Otsego: 607-547-2536

- Schoharie: 518-234-4303

- Saratoga: 518-885-8995

- Erik Smith: 315-219-7786

- Daniela Gonzalez: 315-749-3486

- Ashley McFarland- 315-604-2156

Your county USDA/FSA service center.

- Chenango: 607-334-3231

- Fulton/Montgomery: 518-853-4015

- Herkimer: 315-866-2520

- Madison:315-824-9076

- Otsego: 607-547-8131

- Schoharie: 518-295-8600

- Saratoga: 518-692-9940

Your county farm bureau manager

- Region 3: Bailey Coon: 518-937-0566

- Region 5: John Wagner: 315-761-9770

- Region 6: Natally Batiston: 518-937-0269

- Region 7: Todd Heyn: 518-431-9338

Please let us know how we can help you.

Cash Rent and Custom Harvest Survey

To date, there is limited information available about rental rates and fees for crop harvesting. Farms can use this valuable information for their farm business planning to help improve decision making and profitability.Farmers Can Join MeatSuite For Free!

MeatSuite.com is a free resource provided by Cornell University where NY meat farmers can create a farm profile and list their bulk (wholes, halves, quarters) and bundled (i.e. Grilling Bundle) meat products.Why should farmers join?

1. It's free and easy!

2. Connect with more local customers. In the past year the MeatSuite.com farm directory had 8,300 visits from New York consumers. Farm profiles get as many as 25 views per month from potential local customers. We also spotlight MeatSuite farms on social media and bring attention and purchases to farms through highlights and giveaways.

How do I join?

Farmers can visit https://www.meatsuite.com/farmers/ to create a free farm profile. You must list at least one product for your farm's profile to go live. You'll also have access to Cornell's free Meat Price Calculator, a helpful tool for pricing your meat to make a profit.

While you're on MeatSuite, check out the "Creating Consumer-Friendly Bulk Meats" publication on the log-in page. It has tips on how to create bulk meat products that are easier for first-time buyers to say "yes" to.

If you have any questions as you create your farm profile or products, we're here to help! Please email Matt LeRoux at mnl28@cornell.edu.